In the world of fame and fortune, financial literacy is often an overlooked skill. Yet, for many, including the controversial rapper 6ix9ine, it’s a vital part of sustaining success. His recent $8 million IRS debt serves as a stark reminder that celebrity status does not guarantee financial wisdom. What can we learn from his experience?

What You Will Learn

- The rapid rise to fame can lead to significant financial pitfalls, as seen in 6ix9ine's journey.

- Understanding the intricacies of tax obligations is crucial for anyone managing multiple income streams.

- High spending habits, if left unchecked, can escalate into severe financial issues, highlighting the need for budgeting.

- Engaging financial professionals can provide guidance essential for navigating complex situations like tax debt.

- Community response to financial struggles underscores the importance of public image and personal responsibility.

- Proactive financial practices, such as regular check-ups and staying informed, are vital for long-term stability.

6ix9ine's $8 Million IRS Debt: A Breakdown of Financial Pitfalls

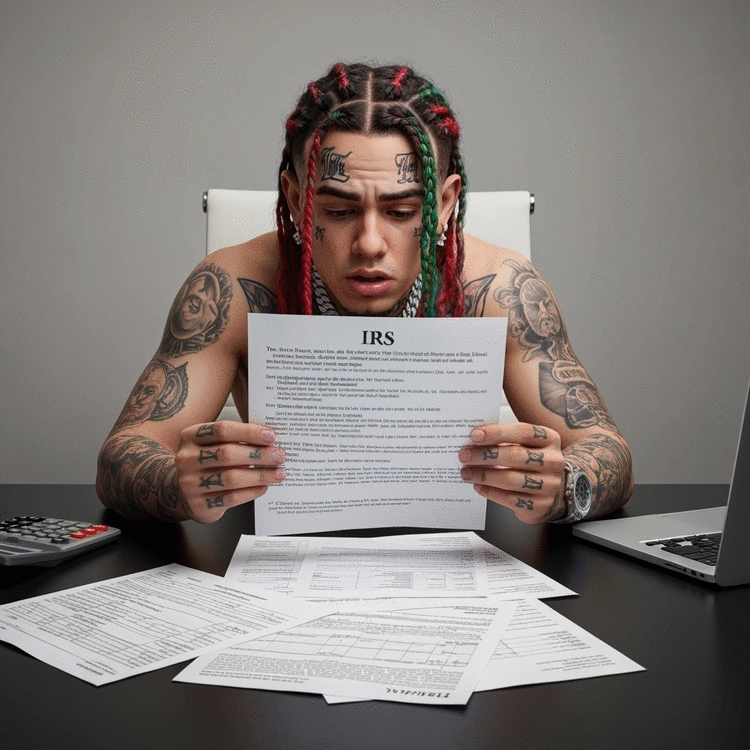

The visual below illustrates the key factors contributing to 6ix9ine's substantial IRS debt and the potential paths forward.

Understanding the Debt Origin

- Unreported Income

- High Spending Habits

- Punitive Penalties

Potential Legal Implications

- Legal Actions

- Reputation Damage

- Asset Seizures

Strategies for Debt Resolution

- Payment Plan

- Offer in Compromise

- Consult Financial Experts

Proactive Financial Practices

- Budgeting & Emergency Funds

- Regular Financial Check-ups

- Investing in Financial Literacy

The Story Behind 6ix9ine's $8 Million IRS Debt

Daniel Hernandez, more commonly known as 6ix9ine, is a figure who has made headlines for both his unique musical style and his tumultuous personal life. Rising to fame with his distinctive persona—characterized by colorful hair, face tattoos, and an unapologetic attitude—6ix9ine has faced numerous controversies that have overshadowed his musical career. Now, his financial struggles, particularly his reported $8 million IRS debt, have brought him back into the spotlight, sparking discussions about the implications of fame and financial mismanagement.

The music industry can be a double-edged sword; while it offers immense opportunities for success, it can also lead to significant financial pitfalls. 6ix9ine's journey exemplifies this reality, as he navigates the challenges of maintaining his public persona while dealing with substantial financial woes. It's a stark reminder that fame doesn't always equate to financial literacy or stability!

Understanding 6ix9ine’s Financial Struggles

6ix9ine's rise in the music scene was meteoric, driven by viral hits and a controversial lifestyle. However, this rapid ascent often comes with a hefty price tag—a lesson many celebrities learn the hard way. In 2023, he shocked fans when news broke of his substantial tax debt, amounting to a staggering $8 million, prompting questions about how someone in his position could find themselves in such a predicament.

- Unique persona and brand appeal

- Recent legal troubles and controversies

- Challenge of managing wealth and taxes

These components illustrate not only the allure of 6ix9ine's brand but also the stark reality of fiscal responsibility that often eludes many in the industry. With fame, the pressure to maintain a lavish lifestyle can sometimes overshadow the crucial need for prudent financial management.

Breakdown of the IRS Debt Claim

According to 6ix9ine, the $8 million tax debt arose from a combination of missed payments and alleged miscalculations. The IRS has strict guidelines, and failure to comply can lead to significant financial consequences. But what exactly contributes to a tax debt of this magnitude? Let’s break it down:

- Unreported income: Artists like 6ix9ine often have multiple income streams that can be easy to overlook.

- High spending habits: A lifestyle of excess can lead to poor financial planning.

- Punitive penalties: The IRS imposes penalties for late filings and payments, escalating debts quickly.

These factors not only highlight the complexity of managing finances as a celebrity but also the urgent need for professional guidance. For someone like 6ix9ine, understanding the nuances of tax obligations is critical, especially as he navigates these challenging waters.

Tax Evasion Allegations: What They Mean for 6ix9ine

As rumors of tax evasion swirl around 6ix9ine, the stakes only grow higher. Tax evasion is a serious accusation that can lead to severe legal consequences, including hefty fines and even imprisonment. If the IRS deems that he intentionally evaded taxes, the implications could be life-altering. In such scenarios, the following points come into play:

- Potential legal actions: The IRS has the authority to pursue legal action against individuals who fail to meet their tax obligations. You can find more information about tax enforcement on the Washington Post, which frequently covers such legal cases.

- Reputation damage: Allegations of tax evasion can tarnish a celebrity's public image and career.

- Financial repercussions: Beyond legal issues, unpaid taxes can lead to asset seizures and further financial strain.

Understanding these allegations is crucial, not only for 6ix9ine but for anyone in the public eye grappling with similar financial challenges. It serves as a reminder that maintaining compliance with tax laws is essential for anyone, regardless of their fame or fortune. NPR often provides in-depth coverage of financial and legal issues that affect public figures.

Pro Tip

To avoid financial pitfalls like those faced by 6ix9ine, consider adopting a comprehensive financial plan early on. This includes not only budgeting and tracking your expenses but also seeking guidance from financial experts who understand the complexities of tax obligations and asset management. Staying informed and proactive can help you navigate the often turbulent waters of fame and fortune.

Looking Ahead: Future Implications for 6ix9ine

What’s Next for 6ix9ine and His IRS Debt?

As 6ix9ine navigates his financial challenges, the crucial question remains: what’s next for him regarding his IRS debt? There are several potential paths he might take to address this overwhelming $8 million obligation. First, he may explore negotiating a payment plan or settlement with the IRS, which could alleviate some immediate pressure.

- Payment Plan: Work with the IRS to set up an installment agreement.

- Offer in Compromise: Possibly settle for less than the total owed if he can prove financial hardship.

- Consulting Financial Experts: Engage tax professionals or financial advisors to create a recovery strategy.

Such decisions are critical for 6ix9ine's future. The way he approaches this debt will not only impact his finances but will also shape his public image. A well-thought-out recovery plan could pave the way for a fresh start in both his personal and professional life.

Exploring Financial Planning and Money Management Strategies

Moving forward, effective financial planning and money management strategies are essential for 6ix9ine. By adopting sound practices, he can avoid repeating past mistakes. Here are some strategies that can help him regain control:

- Budgeting: Create a detailed budget that tracks income and expenses to maintain financial discipline.

- Emergency Fund: Build a safety net to cover unexpected expenses without resorting to debt.

- Investing in Financial Literacy: Take courses or workshops to enhance understanding of financial management.

By prioritizing these strategies, 6ix9ine can better position himself for future success while also rebuilding trust with his fans and community. Financial literacy is key, not just for him but for anyone dealing with the complexities of financial obligations.

Encouraging Responsible Financial Practices

As we reflect on 6ix9ine’s journey, it’s important for readers to consider their own financial habits. Here are a few proactive measures that everyone can take to prevent similar issues:

- Regular Financial Check-ups: Regularly review your financial situation to catch any issues early.

- Stay Informed: Keep up with changes in tax laws and financial best practices.

- Seek Help: Don’t hesitate to consult financial advisors when needed.

These practices can be invaluable in creating a solid foundation for future financial stability. It’s essential to learn from others’ experiences—like 6ix9ine’s—and make informed decisions that promote long-term success.

Engagement and Community Response

How Fans and Followers Are Reacting

The community's response to 6ix9ine’s situation has been as dynamic as his music career. Social media platforms are buzzing with various sentiments, with fans expressing both concern and support. Many take to platforms like Twitter and Instagram to share their thoughts, often showcasing the duality of admiration and critique that surrounds celebrity figures.

- Supportive Messages: Many fans are rallying behind him, offering encouragement and understanding.

- Criticism: Others express disappointment over his financial choices, urging him to take responsibility.

- Calls for Transparency: Fans are demanding more transparency regarding his financial recovery efforts.

This mixed response highlights the importance of community engagement, as fans want to see their favorite artists not only thrive musically but also manage their lives responsibly.

Frequently Asked Questions About 6ix9ine's IRS Debt

What is 6ix9ine's current financial situation?

6ix9ine is currently facing a substantial $8 million IRS debt, which has brought his financial management into public scrutiny.

What are the main reasons for 6ix9ine's IRS debt?

His debt is attributed to a combination of unreported income, high spending habits, and punitive penalties imposed by the IRS for missed payments and alleged miscalculations.

What are the potential legal implications of tax evasion allegations?

Tax evasion allegations can lead to severe legal consequences, including hefty fines, imprisonment, reputation damage, and asset seizures.

What strategies can 6ix9ine use to resolve his debt?

He could explore negotiating a payment plan, making an offer in compromise with the IRS, or consulting financial experts to develop a recovery strategy.

How can individuals prevent similar financial pitfalls?

Adopting proactive financial practices such as budgeting, building an emergency fund, regular financial check-ups, staying informed about tax laws, and seeking professional financial advice can help prevent such issues.

Final Thoughts on 6ix9ine's Financial Future

In wrapping up, 6ix9ine's financial journey serves as a compelling case study on the complexities of financial management. As we observe his story, it’s crucial to extract key takeaways that resonate beyond celebrity culture. From the importance of financial literacy to the impact of community support, there are valuable lessons to learn.

Let’s remain vigilant and informed about our own financial habits. Just like 6ix9ine, we can all benefit from understanding our financial obligations and taking proactive steps towards responsible management. Stay tuned for more insights on financial issues and celebrity news from The Stone Builders Rejected—where we aim to empower our audience with the knowledge they need!

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- 6ix9ine's reported $8 million IRS debt highlights the financial risks associated with fame and poor financial management.

- Key contributors to his debt include unreported income, high spending habits, and punitive penalties from the IRS.

- Allegations of tax evasion could lead to serious legal consequences, impacting his reputation and finances.

- 6ix9ine's future strategies to manage his IRS debt may involve negotiating payment plans and consulting financial advisors.

- Adopting sound financial practices, such as budgeting and building an emergency fund, is essential for long-term stability.

- Readers are encouraged to reflect on their own financial habits and consider regular check-ups and professional guidance.