As we navigate the complexities of retirement planning, understanding the upcoming 2.8% Social Security Cost-of-Living Adjustment (COLA) for 2026 is essential. This increase is not just a number; it signifies potential shifts in retirees' financial landscapes. How can this adjustment impact your future? Let's explore the key insights that will empower you to make informed decisions.

What You Will Learn

- The 2.8% COLA aims to help retirees maintain their purchasing power amidst rising costs.

- Understanding the calculation based on the Consumer Price Index for Urban Wage Earners (CPI-W) is crucial for grasping how benefits are adjusted.

- The Bureau of Labor Statistics plays a vital role in ensuring these adjustments reflect real economic conditions.

- Staying updated on Social Security developments can significantly influence your financial planning and budgeting strategies.

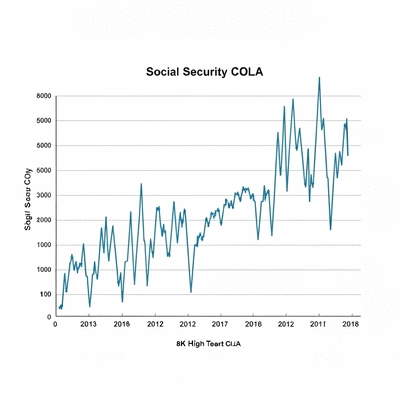

Social Security COLA Calculation & Impact

The 2.8% COLA for 2026 is determined by the CPI-W and aims to help retirees maintain purchasing power. Below is a breakdown of the process and its implications.

COLA Calculation: CPI-W Focus

The COLA is primarily calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), reflecting everyday expenses.

- ✓ Mix of expenses: housing, transport, food

- ✓ Shifts with consumer habits

BLS Role in COLA Accuracy

The Bureau of Labor Statistics (BLS) ensures COLA accuracy by gathering and analyzing CPI-W data, maintaining program integrity.

- ✓ Gathers consumer price data

- ✓ Ensures data-driven decisions

Understanding the 2.8% Social Security COLA for 2026

The recent announcement of a 2.8% increase in Social Security benefits for 2026 is significant news for retirees. This adjustment, known as the Cost-of-Living Adjustment (COLA), is designed to help beneficiaries keep pace with rising living costs. For many, this increase can make a noticeable difference in their monthly budgets, especially as prices continue to fluctuate in various sectors of the economy.

As someone who cares deeply about the implications of financial decisions on everyday life, I find it vital to understand how these adjustments can impact retirement planning. In this post, we'll delve into the details of the COLA increase and what it means for those relying on Social Security.

Announcement of the 2026 Cost-of-Living Adjustment

The announcement of the 2.8% COLA for 2026 reflects ongoing adjustments necessary to accommodate economic changes. This increase emerges from the broader economic context where inflation has been a persistent concern. As we analyze this adjustment, it's essential to recognize its implications for those who depend on Social Security for their day-to-day expenses, as detailed in the Social Security Administration's COLA summary.

- Helps retirees maintain purchasing power.

- Affects overall financial planning and budgeting for seniors.

- Significant for those living on fixed incomes.

For many retirees, understanding the nuances of the COLA can guide them in making informed financial decisions. This increase emphasizes the need for continuous awareness of how such adjustments will affect their long-term financial stability.

How the COLA is Calculated: Insights into CPI-W

The calculation of the COLA is rooted in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index measures changes in the cost of living based on the spending patterns of urban workers, which can vary significantly from year to year. It serves as a benchmark for determining how much benefits should increase to reflect inflation accurately. More information on how COLA is calculated can be found on the Social Security Administration's COLA page.

- The CPI-W is based on a mix of expenses, including housing, transportation, and food.

- Changes in the CPI-W directly influence adjustments to Social Security benefits.

- This method aims to ensure that retirees can afford basic necessities.

Understanding the CPI-W allows individuals to appreciate the rationale behind the adjustments made to their benefits. It showcases how shifts in consumer habits and economic conditions inform these important financial decisions.

Role of the Bureau of Labor Statistics in COLA Calculation

The Bureau of Labor Statistics (BLS) plays a critical role in the process of calculating the COLA. By gathering and analyzing data related to the CPI-W, the BLS ensures that the adjustments reflect current economic realities. This oversight is crucial for maintaining the integrity of the Social Security program, as highlighted in official COLA fact sheets.

With their expertise, the BLS contributes to ensuring that the COLA is as accurate and fair as possible. For retirees, this means they can trust that their benefits are being adjusted based on reliable data and sound methodologies.

- BLS gathers data on consumer prices regularly.

- They provide transparency and accountability in the COLA calculation process.

- Their work helps ensure that retirees receive benefits that align with actual living costs.

In conclusion, the BLS's involvement in the COLA calculation not only safeguards the welfare of beneficiaries but also highlights the importance of data-driven decision-making in public policy. It’s an essential aspect of how we can navigate the complexities of retirement income.

Frequently Asked Questions About the 2026 Social Security COLA

Q: What is the 2026 Social Security COLA?

A: The 2026 Social Security Cost-of-Living Adjustment (COLA) is a 2.8% increase in Social Security benefits, designed to help retirees maintain their purchasing power amidst rising living costs.

Q: How is the COLA calculated?

A: The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of living based on typical urban worker spending patterns, including expenses like housing, transportation, and food.

Q: What is the role of the Bureau of Labor Statistics (BLS) in COLA calculation?

A: The BLS plays a critical role by gathering and analyzing CPI-W data to ensure that COLA adjustments accurately reflect current economic realities. This ensures the integrity and fairness of the Social Security program.

Q: Why is understanding the COLA important for retirement planning?

A: Understanding the COLA is crucial because it directly impacts retirees' financial security by adjusting their monthly benefits. It helps them account for inflation, manage their budgets, and make informed decisions about their long-term financial stability.

Q: Where can I find official information about Social Security COLA?

A: You can find official information and stay updated on COLA developments by regularly consulting the Social Security Administration's (SSA) official website and subscribing to their newsletters.

Interactive Poll: Your Thoughts on COLA

As we explore the implications of the 2.8% Social Security COLA for 2026, we want to hear from you! How do you feel about this increase? Will it significantly impact your financial planning?

Informed Decision-Making for Retirement Planning

Understanding the 2026 Cost-of-Living Adjustment (COLA) is crucial for retirees as it directly impacts financial security. With the announced 2.8% increase, it's essential to grasp not just the numbers but also the broader economic implications this adjustment carries. Many retirees may not realize how changes in COLA affect their purchasing power and overall quality of life.

As someone who covers the latest trends in finance and economics, I see the importance of proactive retirement planning. By staying informed about COLA updates, retirees can make well-considered decisions about their finances. Here are some key takeaways:

- Recognize how the COLA increase can adjust your monthly budget.

- Consider the potential impact of inflation on future purchasing power.

- Evaluate your current investments and how they align with expected adjustments.

By focusing on these aspects, retirees can better navigate their financial futures with confidence. Remember, it's not just about the current adjustment but also how it fits into your long-term retirement strategy!

Staying Updated and Engaged with Social Security Developments

With changes in Social Security policies always on the horizon, I encourage everyone to stay updated. Regularly consulting official Social Security Administration (SSA) resources can provide invaluable insights into how these changes will affect your benefits. It's also wise to consider seeking advice from financial professionals who can offer personalized guidance tailored to your unique situation.

Here are some effective ways to remain engaged:

- Subscribe to SSA newsletters for the latest updates.

- Join online forums or communities focused on retirement planning.

- Consult with financial advisors who specialize in Social Security benefits.

By adopting these practices, you’re not just staying informed; you're actively participating in your financial well-being. As we navigate the complexities of retirement planning together, let’s remember that being proactive today can lead to a more secure tomorrow!

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- The 2.8% COLA for 2026 helps retirees maintain their purchasing power amidst rising costs.

- Understanding the CPI-W is crucial as it directly influences adjustments to Social Security benefits.

- The Bureau of Labor Statistics ensures the accuracy and fairness of the COLA calculation.

- Regularly staying updated with Social Security changes is vital for informed retirement planning.

- Consider the impact of inflation on future purchasing power when planning your retirement finances.