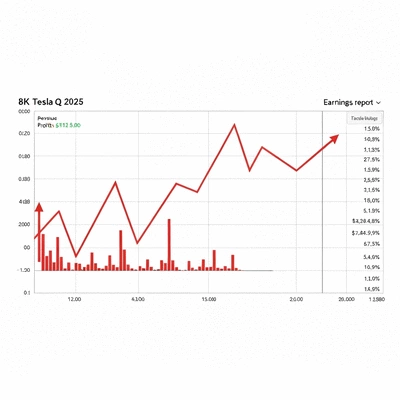

As Tesla navigates the complexities of the electric vehicle market, its recent Q3 2025 earnings report showcases both challenges and opportunities. Understanding these dynamics is crucial for investors and enthusiasts alike.

What You Will Learn

- Revenue and EPS Decline: Tesla's reported revenue of $21 billion and EPS of $0.55 fell short of analysts' expectations, indicating potential market volatility.

- Increased Expenditures: Rising R&D costs and supply chain issues contributed significantly to the earnings miss this quarter.

- Focus on Innovation: Tesla's commitment to advancements in AI and autonomous vehicle technology remains crucial for future growth despite current challenges.

- Market Risks: Ongoing economic volatility and regulatory challenges could affect consumer demand and Tesla's sales in the coming months.

Tesla's Q3 2025 Earnings Performance & Contributing Factors

An overview of Tesla's Q3 2025 financial results, including key figures and the primary reasons for the reported earnings miss.

Q3 2025 Financial Highlights

Key metrics undershooting analyst expectations.

- Revenue: $21B (Exp: $23B)

- EPS: $0.55 (Exp: $0.70)

- Margins: 13% (Prev: 16%)

Factors Contributing to Decline

Challenges impacting profitability and delivery schedules.

- • Increased Operating Costs (Production & Logistics)

- • R&D Expenditures (New Tech & Products)

- • Supply Chain Challenges (Parts & Delays)

Key Risks for Growth

External and internal factors potentially hindering future expansion.

- • Market Volatility (Economic Fluctuations)

- • Consumer Demand (Preferences/Conditions)

- • Regulatory Challenges (Gov. Policies)

Investor Watchlist

Key areas for investors to monitor for insights.

- • Supply Chain & Cost Management Updates

- • Robotaxi Program Advancements

- • EV Market Consumer Demand Trends

Understanding Tesla's Q3 2025 Earnings Miss

As a news outlet dedicated to delivering insightful coverage, we turn our focus to Tesla's recent Q3 2025 earnings miss. The reported figures have stirred quite the conversation among investors and market analysts alike. Let’s break down the key financial highlights that shaped this earnings report.

Key Financial Highlights from the Earnings Report

Tesla's earnings report revealed a revenue of $21 billion, which fell short of analyst expectations of $23 billion. Additionally, the earnings per share (EPS) came in at $0.55, compared to forecasts of $0.70. The margins also took a hit, reflecting a decline to 13% from the previous quarter's 16%. These figures have raised eyebrows, particularly given the strong growth trajectory Tesla has maintained over the past few years. For a comprehensive overview of Tesla's financial performance, you can review the Q3 2025 Update PDF directly from Tesla's Investor Relations.

- Revenue: $21 billion (expected: $23 billion)

- EPS: $0.55 (expected: $0.70)

- Margins: 13% (previous: 16%)

Investors expected a different outcome based on Tesla's exciting advancements in technology and their strong foothold in the EV market. However, the reality has prompted discussions about what lies ahead for this pioneering company.

Factors Contributing to the Earnings Decline

Several factors contributed to the earnings decline this quarter. Increased operating costs have affected profitability, as Tesla has invested significantly in expanding production capabilities and ramping up research and development (R&D). The ongoing challenges within the supply chain have also not helped, with delays and shortages impacting delivery timelines and overall efficiency. Detailed financial results and conference call analyses are often available on Tesla's Investor Relations website, providing further context to these contributing factors.

- Increased Operating Costs: Higher expenses related to production and logistics.

- R&D Expenditures: Significant investment in new technology and product development.

- Supply Chain Challenges: Ongoing disruptions affecting parts availability and delivery schedules.

These elements have created a challenging environment for Tesla, leading many to question how the company will navigate these obstacles moving forward.

Evaluating Risks and Future Growth Potential

As we delve deeper, it’s clear that there are risks that could impact Tesla’s growth in the near future. Market volatility can significantly influence consumer demand, particularly in the current economic climate. With rising interest rates and inflationary pressures, potential buyers may reconsider their purchasing decisions regarding electric vehicles. For official press releases and further insights into Tesla's market position, visit the Tesla Investor Relations press release page.

- Market Volatility: Economic fluctuations affecting consumer purchasing power.

- Consumer Demand: Changes in preferences or economic conditions that may hinder sales.

- Regulatory Challenges: New government policies impacting vehicle production and sales.

These risks necessitate a strategic approach from Tesla. The ability to adapt and innovate will be crucial as the company seeks to maintain its position as a leader in the electric vehicle space.

Interactive Poll: What Do You Think?

Given Tesla's recent earnings miss, how do you feel about the company's future growth potential in the electric vehicle market?

Frequently Asked Questions about Tesla's Q3 2025 Earnings

Here are some common questions regarding Tesla's recent financial performance and future outlook.

Q: What were the key financial figures from Tesla's Q3 2025 earnings report?

A: Tesla reported revenue of $21 billion, falling short of the expected $23 billion. Earnings per share (EPS) were $0.55, below the forecast of $0.70. Margins also decreased to 13% from the previous quarter's 16%.

Q: What factors contributed to Tesla's earnings miss?

A: The primary factors included increased operating costs due to production and logistics, significant R&D expenditures for new technology, and ongoing supply chain challenges affecting parts availability and delivery schedules.

Q: What are the main risks to Tesla's future growth?

A: Key risks include market volatility (economic fluctuations), changes in consumer demand (preferences or conditions), and regulatory challenges (new government policies impacting vehicle production and sales).

Q: What should investors monitor regarding Tesla's future performance?

A: Investors should keep an eye on updates regarding supply chain resilience and cost management strategies, advancements in the Robotaxi program, and general consumer demand trends in the electric vehicle market.

Q: Is Tesla still committed to innovation despite the earnings miss?

A: Yes, despite the challenges, Tesla's commitment to innovation, particularly in AI and autonomous vehicle technology, remains a crucial area for future growth and a core part of its long-term vision, including projects like the Robotaxi initiative.

Conclusion and Future Outlook for Tesla

As we reflect on Tesla's Q3 2025 earnings report, it's clear that several factors have shaped the company's current standing in the automotive market. The earnings miss, driven by rising operational costs and supply chain challenges, highlights the need for strategic adjustments moving forward. Yet, amid these challenges, Tesla's commitment to innovation and growth continues to shine through.

Key takeaways from the earnings report indicate that while Tesla has faced hurdles, its long-term vision and projects, such as the Robotaxi initiative, present significant opportunities. As we look ahead, understanding these dynamics will be crucial for gauging Tesla's trajectory.

Summarizing Key Takeaways from the Q3 2025 Earnings

- Revenue and EPS Decline: Tesla fell short of analyst expectations, indicating potential market volatility.

- Increased Expenditures: Rising R&D costs and supply chain issues contributed to the earnings miss.

- Focus on Innovation: Despite challenges, Tesla's initiatives in AI and autonomous vehicles remain a focal point for growth.

These insights suggest a mixed but hopeful outlook for Tesla, especially if they can manage costs and leverage their innovative edge effectively. Investors should remain vigilant about market responses as they navigate these changes.

What Investors Should Keep an Eye On

For those investing in Tesla, it's essential to remain informed about several factors that could influence future performance. Here are some actionable insights to consider:

- Monitor updates on supply chain resilience and cost management strategies.

- Watch for announcements regarding advancements in their Robotaxi program.

- Pay attention to consumer demand trends in the electric vehicle market.

Staying updated on these aspects will empower investors to make informed decisions and strategize accordingly.

Engage with the Latest Developments in Tesla

Stay Informed and Updated on Tesla's Progress

As developments continue to unfold, keeping a close watch on Tesla's financial health and strategic initiatives is paramount. The landscape of electric vehicles is rapidly changing, and Tesla's responses will be pivotal for its sustainable growth. Following credible news sources and engaging with community discussions can provide valuable insights.

Join the Discussion on Tesla's Future

I encourage readers to share their perspectives on Tesla’s growth and the future of electric vehicles! Join the conversation and let us know what you think about Tesla's ability to navigate these challenges and expand its influence in the market.

Understanding Tesla's Role in the Global Electric Vehicle Landscape

Tesla's impact transcends borders, significantly influencing global expansion efforts within the electric vehicle market. With an emphasis on sustainable energy, Tesla not only shapes industry trends but also affects regulatory frameworks worldwide. As such, understanding this role is vital for recognizing how Tesla will continue to reshape the automotive landscape.

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Revenue and EPS Decline: Tesla's revenue was $21 billion, short of the expected $23 billion, with EPS at $0.55 versus a forecast of $0.70.

- Increased Expenditures: Rising operational costs and R&D investments contributed to the earnings miss, highlighting ongoing supply chain challenges.

- Focus on Innovation: Despite hurdles, Tesla's commitment to innovation, especially in AI and autonomous vehicles, remains a key growth area.

- Market Volatility Impact: Economic fluctuations pose risks to consumer demand, necessitating strategic adjustments from Tesla.

- Investor Vigilance: Investors should monitor updates on supply chain resilience, advancements in the Robotaxi program, and trends in consumer demand.