As we approach 2025, understanding the intricacies of geopolitical risks is crucial for investors. The relationship between international politics and market dynamics can significantly influence your investment strategies. Here’s what you need to know to navigate this complex landscape effectively.

What You Will Learn

- Geopolitical risks encompass political events that can disrupt normal market functions, such as wars and trade disputes.

- Increased geopolitical uncertainty often drives investors to seek safer assets, leading to market volatility.

- Economic sanctions can limit market access and influence industry-specific investment strategies.

- Staying informed about geopolitical trends and events is essential for making proactive investment decisions.

- Diversifying your portfolio can help mitigate risks associated with geopolitical tensions.

- Regular assessments of geopolitical factors and legislative changes are vital for adapting your investment strategies.

Key Geopolitical Risks for Investors in 2025

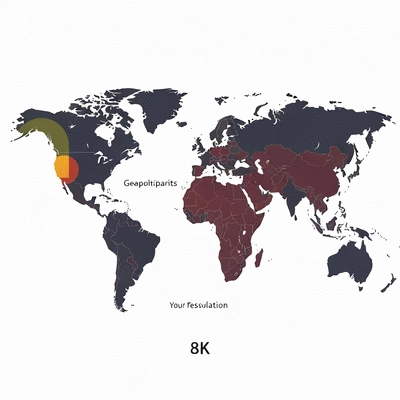

Understanding the interplay between geopolitical events and financial markets is crucial for making informed investment decisions. The visual below highlights the primary risk categories and their impact. For a deeper dive into how global events are shaping the future, explore our article on Global Conflicts Shaping Tomorrow's Affairs.

Geopolitical Risks Impacting Markets

Uncertainties from international politics and conflicts significantly affect market dynamics, leading to fluctuating asset prices.

Risk Category 1:

Political Conflicts

- Wars or military actions

- Regional destabilization

Risk Category 2:

Trade Policies & Sanctions

- Tariffs & sanctions

- Altered investment viability

Risk Category 3:

Government Instability

- Leadership changes

- Policy shifts & market confidence

Key Investor Action:

Diversification

- Mitigates localized risks

- Spreads investment exposure

Understanding Geopolitical Risks in 2025

As we step into 2025, having a clear understanding of geopolitical risks becomes essential for both seasoned and novice investors. These risks pertain to the uncertainties that arise from international politics and conflicts, which can significantly impact market dynamics. Recognizing the importance of these risks can not only guide investment decisions but also serve as a roadmap for adapting to an ever-changing global landscape.

Investors must grasp how geopolitical events shape economic landscapes. For instance, tensions between nations can lead to fluctuating asset prices, affecting everything from stocks to commodities. Understanding these dynamics allows investors to make informed decisions that can safeguard their portfolios.

Defining Geopolitical Risks and Their Importance for Investors

So, what exactly are geopolitical risks? In simple terms, they encompass any political event that can disrupt the normal functioning of markets, such as wars, trade disputes, and elections. For investors, these risks are pivotal because they can alter economic forecasts and lead to unforeseen fluctuations in asset valuations.

- Political Conflicts: Wars or military actions that can destabilize regions.

- Trade Policies: Tariffs or sanctions that can affect international trade relations.

- Government Instability: Changes in leadership or policy that can influence market confidence.

Understanding these elements is crucial for making strategic investment choices, especially in a rapidly evolving global climate.

The Role of Geopolitical Uncertainty in Financial Markets

Geopolitical uncertainty is more than just headlines; it's a significant force that can drive market behavior. When uncertainty rises, investors often react by seeking safer assets, which can lead to market volatility. This volatility presents both risks and opportunities—understanding how to navigate it can be the difference between profit and loss. To learn more about navigating market shifts, consider our insights on US-China Relations and Global Impact, as these dynamics often influence market sentiment.

- Flight to Safety: Increased demand for gold or government bonds during times of uncertainty.

- Market Overreactions: Short-term price swings that can create buying opportunities.

- Sector Rotation: Shifts in investment focus towards more stable sectors like utilities or consumer staples.

By staying informed about geopolitical risks, investors can position themselves advantageously in the market, even when uncertainty looms.

The Impact of Economic Sanctions on Global Investment Strategies

Economic sanctions are a powerful tool in international relations, often imposed to exert pressure on governments or regimes. For investors, understanding the implications of these sanctions is crucial. These restrictions can limit market access and alter investment viability in affected countries.

- Sector Exposure: Certain industries, like energy and defense, can see significant shifts due to sanctions.

- Market Access: Sanctions can restrict investors from entering or operating in specific markets.

- Long-term Strategies: Investors must assess how sanctions impact long-term growth potential in various regions.

By evaluating these factors, investors can better navigate the complexities of global investment strategies in an increasingly interconnected world.

Interactive Poll: Your Thoughts Matter!

As we navigate the complex landscape of geopolitical risks, we want to know your perspective. How do you believe geopolitical events will impact your investment strategy in 2025?

Summarizing the Impact of Geopolitical Risks on Investments

As we look ahead to 2025, it's crucial for investors to understand the complex relationship between geopolitical risks and their investment strategies. The events unfolding on the global stage can create both challenges and opportunities. By staying informed about these risks, we can better navigate the uncertainty that comes with fluctuations in markets due to political developments.

To effectively manage investments in this environment, here are some key takeaways to consider:

- Stay Educated: Knowledge about geopolitical tensions is vital for making informed decisions.

- Diversify Your Portfolio: A broad investment strategy can help mitigate risks.

- Monitor Economic Indicators: Understanding the economic implications of geopolitical events can guide adjustments in strategy.

- Be Proactive: Anticipating changes can position you advantageously in volatile markets.

Each of these points emphasizes the need for a proactive approach that can lead to more resilient investment strategies. As the team at The Stone Builders Rejected, we emphasize the importance of adaptability and ongoing education in the face of uncertainty.

Key Takeaways for Investors Navigating 2025

For those of us navigating the complexities of investment in 2025, understanding the key takeaways is essential. Here are some critical insights:

- Geopolitical events: Stay informed about conflicts and diplomatic relations that could impact markets.

- Market Volatility: Prepare for fluctuations in asset prices as a result of geopolitical tensions.

- Regulatory Changes: Monitor changes in legislation that may impact industries differently.

- Crisis Management: Have contingency plans ready to address unexpected geopolitical challenges.

These takeaways provide a roadmap for making informed investment decisions. During my discussions with peers in the investment community, it’s clear that a well-rounded perspective on these factors can greatly influence success.

Actionable Insights for Future Investments

As we prepare for the evolving landscape in 2025, it's important to implement actionable insights into our investment strategies. Here are several strategies that will ensure you're well-prepared:

- Utilize Reliable Sources: Following reputable news outlets and expert analyses can provide valuable insights.

- Engage with Financial Experts: Consulting with advisors who specialize in geopolitical risks can enhance your understanding.

- Participate in Investment Communities: Engaging with other investors can foster discussions about strategies and sharing knowledge.

Embracing these actionable insights not only equips us with the tools necessary to adapt but also fosters a community of informed investors, which can be incredibly beneficial. At The Stone Builders Rejected, we believe in empowering our audience with the most relevant and timely information to navigate these challenges.

How to Stay Informed and Adapt Your Strategy

Staying informed is key to adapting your investment strategy amid geopolitical changes. Here’s how:

- Subscribe to Newsletters: Regular updates from experts can keep you abreast of geopolitical developments.

- Utilize Social Media: Follow thought leaders in finance and geopolitics on platforms like Twitter or LinkedIn.

- Attend Webinars and Conferences: These events often provide insights from industry experts and analysts.

Leveraging these resources allows you to remain agile and responsive to new information, ensuring that your investment strategy aligns with the dynamic global landscape. Remember, being proactive is always better than being reactive!

Encouraging Ongoing Assessment of Geopolitical Factors

To effectively manage investments, ongoing assessment is essential. Here are strategies to keep your assessments current:

- Conduct Regular Reviews: Set aside time to review your investments in light of new geopolitical insights.

- Adjust Your Risk Tolerance: Consider how geopolitical risks affect your comfort level with certain investments.

- Engage in Continuous Learning: Make it a habit to learn about emerging geopolitical trends that may affect your investments.

This ongoing assessment not only strengthens our investment strategies but fosters a culture of preparedness as well.

Monitoring Legislative Changes and Their Economic Implications

Legislative changes can significantly impact investment environments. Here’s how to monitor effectively:

- Follow Government Reports: Stay updated on new laws and policies affecting industries and economies.

- Join Industry Associations: Networking with professionals who track legislation can provide valuable insights.

- Leverage Technology Tools: Use apps or online tools that alert you to legislative changes. For insights into how technological advancements influence various sectors, check out our article on AI Technologies to Watch in 2025, which could also be impacted by legislative shifts.

By closely monitoring these changes, we can position ourselves to respond quickly, mitigating potential risks and capitalizing on new opportunities. It's a crucial part of the investment journey, especially in a landscape as uncertain as today’s.

FAQs About Geopolitical Risks and Investment Strategies

Recap of Key Points

Here is a quick recap of the important points discussed in the article:

- Understand Geopolitical Risks: Recognize how political events can disrupt markets and affect investment strategies.

- Adapt to Market Volatility: Monitor how geopolitical uncertainties can drive demand for safer assets and lead to price swings.

- Assess Economic Sanctions: Evaluate how sanctions impact specific sectors and long-term growth potential in affected regions.

- Stay Informed: Keep abreast of geopolitical developments through reliable news sources and expert analyses.

- Diversify Investments: A broad investment strategy can help mitigate risks associated with geopolitical events.

- Conduct Regular Reviews: Continuously assess your investment portfolio in light of new geopolitical insights and adjust your risk tolerance accordingly.